a solid methodology based on diversification

The 7Q Retirement Partners does not measure its investment success using a benchmark comparison, but rather pursues a stated target return. The required target return is defined by the investment policy statement (IPS) which is periodically reviewed. This return should be achieved through a robust portfolio structure, rigorous risk control, and active portfolio management. The focus here is on exploiting long-term return drivers, capitalizing on opportunities that arise, and active risk monitoring.

The 7Q Retirement Partners bases its asset management on a robust core portfolio combined with an overlay strategy that enables rapid reaction to changing market conditions and tactical adjustments to the asset allocation.

Growth and preservation of retirement wealth in the medium and long term, emphasising prudent investment management.

In order to achieve our objective, we rely on four basic premises.

The 7Q Retirement Partners portfolios comprise of two key components.

Robust component

- An effective & efficient way of managing portfolio risk

- Makes it possible to minimize losses arising from adverse market events

- Is broadly represented in our Multi Asset Sustainable portfolio

- Constitutes the average risk budget

- Represents our long-term allocation

Tactical component

- Is adjusted dynamically according to the evolution of economic and financial cycles

- A systematic investment strategy which employs Risk On – Risk Off signals

- Results from the arbitrage between the expected return and its risk contribution to the whole portfolio

You, the member, are our central concern.

The investment process focuses on risk control and diversification. The approach is based on the conviction that effective risk management and true global diversification helps generate robust returns over time.Focus on risk

Risk control is central to our investment process, as illustrated by:

- The preservation of capital over a typical economic cycle ensured by the robust portfolio

- Continuous monitoring of each asset class’s contribution to the portfolio’s overall level of risk

- Special attention is paid to the maximum drawdown risk

- A separate overlay to protect portfolios during periods of market stress

Diversification

True global diversification is the cornerstone of our portfolios:

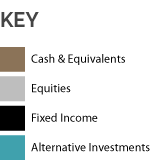

- Asset classes are selected for their ability to contribute towards diversification, especially in adverse circumstances

- This is the most effective way to reduce specific risk

- We balance risk across different macro environments (i.e. rising growth, falling growth, rising inflation, and falling inflation)

Our investment philosophy

Wealth preservation is about building portfolios that deliver more stable returns across a variety of different economic and financial cycles.

Our investment approach

Our investment approach is simple and transparent, allowing members to understand how, where and why we are taking (or reducing) risk in order meet their retirement objectives. It is also flexible, recognising that members’ needs – and the market’s reward for risk – vary over time.

The 7Q team

The 7Q team has been managing multi-asset portfolios for more than 50 years, collectively. We design, implement and manage solutions aimed at meeting our clients’ desired outcomes. The 7Q investment team carries out its activities strictly according to defined investment processes and guidelines.

We design and implement outcomes to meet the retirement needs of our members.

Member Outcomes |

Type of Profile |

Risk Level |

|---|---|---|

Risk-controlled growthTargets growth-like returns with reduced volatility through diversification and dynamic asset allocation |

Multi Asset DynamicThis portfolio is suited to members with a longer-term investment horizon |

Medium-High risk |

Wealth preservation, growthModerate total return strategy applying risk-based portfolio construction |

Multi Asset SustainableThis portfolio is suited to members who seek inflation hedged income and capital growth |

Low-Medium risk |

Inflation protection, wealth preservationAims to protect from inflation and inflation shocks Conservative total return strategy applying risk-based portfolio construction |

Multi Asset DefensiveThis portfolio is suited to more conservative members nearing retirement |

Limited risk |

Stable store of monetary valueOffers a high degree of capital protection |

Money MarketThis portfolio is suited to members who seek a stable store of monetary value |

Minimal market risk |

Investment Profiles

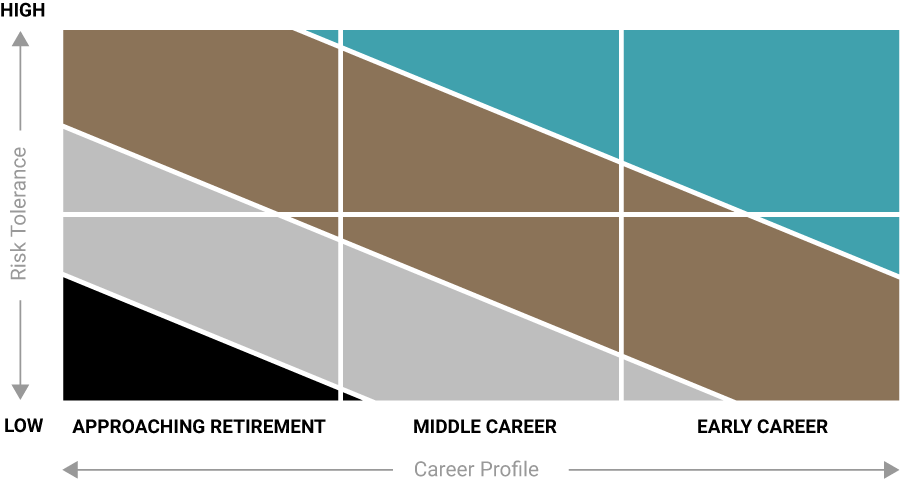

Under the 7Q Retirement Partners, four investment profiles are available, allowing each member to have a personalised retirement solution suited to their individual needs. Life Staging is available if elected.

Money Market

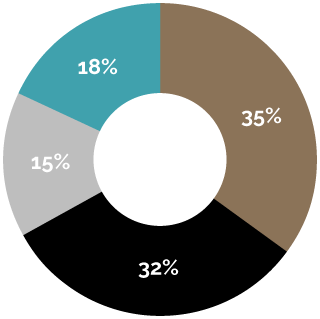

Multi Asset Defensive

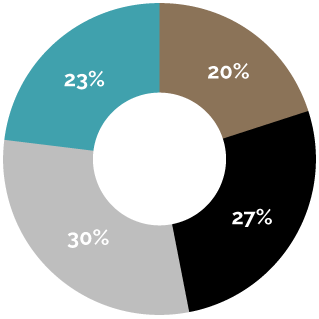

Multi Asset Sustainable

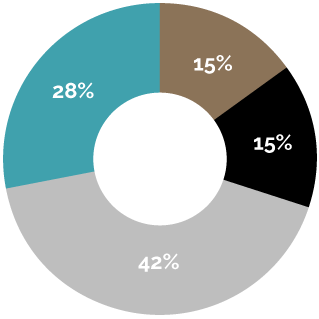

Multi Asset Dynamic

Choosing a suitable retirement plan

In order to choose the retirement plan that best matches your expectations, you first need to determine two parameters: your risk tolerance (in other words your capacity to accept fluctuations in the value of your investment) on the one hand, and the expected duration of your investment (in other words the years left until your retirement) on the other.